Fully Insured Versus Level-Funded: Choosing the Right Plan for Your Workers Among the Best Health Insurance Companies

7 Minutes

Team Curative

May 16, 2023

Shopping for the best health insurance Texas has to offer for your employees can be tricky, for large and small employers. With health benefit costs per employee expected to climb 5.6 percent this year, employers are left with the difficult task of reigning in increasing health care costs while ensuring affordable coverage for employees and remaining attractive to prospective talent. Some employers’ shifting rising costs to members can hamper recruiting efforts amid a competitive labor market. As a result, most opt instead for multiple strategies to manage health care costs while remaining affordable for members. One strategy includes choosing between a fully insured or self-funded plan.

With a fully insured care plan, employers contract with an insurance company that accepts financial responsibility for employee medical claims. Under a self-funded plan, employers assume financial responsibility for employee medical claims. Typically, employers with self-funded plans work with a third-party insurer that supplies administration services. Recently, insurers have started offering a more manageable level-funded coverage option under the umbrella of self-funded plans. Under a level-funded plan, employers pay a “level premium” that covers costs related to administrative fees, maximum claims liability, and stop-loss insurance to offer predictability and reduce the risks of traditional self-funded plans.

The best health insurance companies know the pivotal role they play in guiding employers through the fully insured vs. level-funded decision-making process, understanding that each company has unique needs that warrant careful consideration. As an employer, you can choose the best plan for your business by reviewing the ins and outs of the two coverage options.

Fully insured plans

When most people think of insurance, fully insured plans usually come to mind. This type of plan is the traditional route employers choose when insuring members, wherein employers pay a fixed annual premium based on the number of members enrolled in the health plan. The insurance company then issues policy documents outlining the plan’s benefits and takes over enrollees’ medical claim expenses deemed eligible. Most common among small-to-mid-level companies with 50-1,000 employees, fully insured plans come with a range of advantages for employers:

The insurance carrier assumes all financial risk, protecting employers.

Premium rates are fixed annually—rates stay the same month to month.

The insurer handles administrative services, saving time and money for employers.

While certain employers may choose an option for their workforce other than a fully insured plan, the financial predictability of a fully insured plan is a benefit many Texas employers can’t turn down.

Level-funded plans

With ongoing disparities in health care costs, many Texas employers are looking to level-funded plans as a solution. Level-funded plans function as a hybrid solution of fully-funded and self-funded plans, allowing employers to keep some of the predictability fully-funded plans provide while moving into the self-funding world. Under a level-funded plan, employers pay a fixed monthly amount, reviewed annually, to an insurance company that covers three key areas:

Estimated cost for expected claims only

Premium for stop-loss insurance (for health costs over a certain amount)

Administration costs

At the end of the plan year, insurance carriers conduct a review and either issue a refund to employers for lower claims or increase the premium on stop-loss insurance for higher claims, depending on total claim costs for the period. If money is left over, insurance carriers typically split an agreed-upon amount with the employer while keeping a certain percentage for administration fees and other costs. Thus, level-funded plans are a great option for employers looking for more cost transparency in their health plans vs. fully insured options.

When deciding which plan to go with among the best health insurance Texas features, employers can consider also stop-loss insurance. Stop-loss insurance is critical to lower an employer’s risk under level-funded plans, as it caps an employer’s financial responsibility for claims over a set amount. That way, employers mitigate the risk of a traditional self-insured plan while benefiting from the reliability of a fully insured plan. Though employers may lose money in the first year of a level-funded plan, they can look forward to long-term gains in the form of potential refunds, particularly if members stay healthy.

Curative’s fully-funded and level-funded plans

The best health insurance companies prioritize transparency, simplicity, and affordability for their members. They also listen to the unique needs of employers in their communities, offering a range of health plan options. Curative recognizes that choosing the right health insurance Texas providers is an important decision, and plans are not one-size-fits-all. That’s why we’re expanding our health plan options to offer two options for Texas employers: fully-funded and level-funded.

Under the fully-funded plan, Curative serves its members by assuming all risk, responsibility, and administration service requirements of the employer and providing employees with high-quality care. The fully insured option is available to employers with at least 51 employees in 20 counties across the Austin and San Antonio regions, as well as Harris County in the Houston area, with plans to expand statewide soon.

Curative’s level-funded plan is available now to any employer with at least 20 employees throughout the state of Texas. The plan follows Curative’s revolutionary health insurance model on a self-funded plan that includes no copays or deductibles for in-network care. Curative assumes administration service requirements as well as claims processing for the employer, so members can focus on care, not costs. No matter which Curative plan you choose, your member benefit from the same extensive PPO network of providers and true cost transparency.

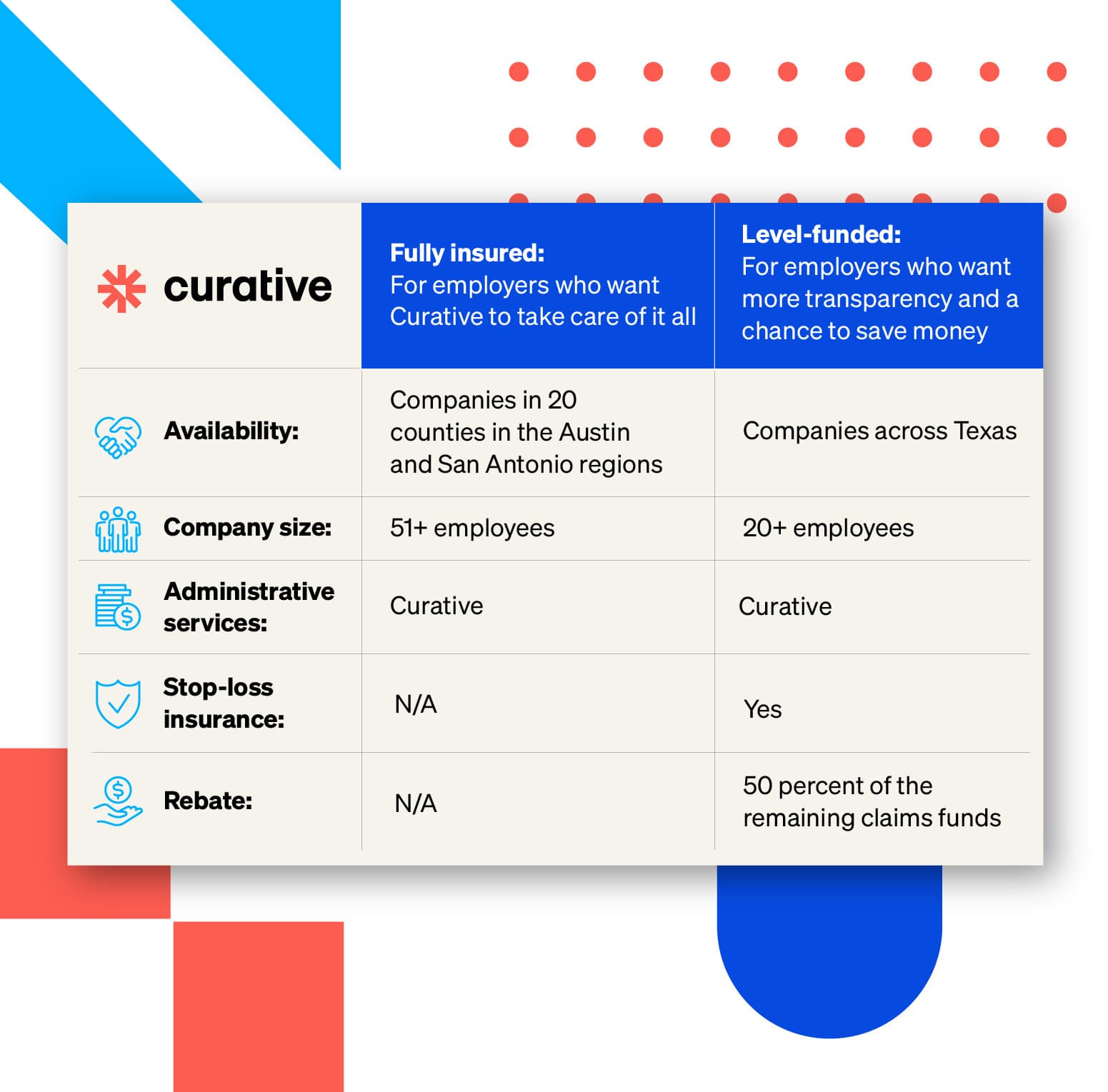

Fully insured:

For employers who want Curative to take care of it all

Availability: Companies in 20 counties in the Austin and San Antonio regions

Company size: 51+ employees

Administrative services: Curative

Stop-loss insurance: N/A

Rebate: N/A

Level-funded:

For employers who want more transparency and a chance to save money

Availability: Companies across Texas

Company size: 20+ employees

Administrative services: Curative

Stop-loss insurance: Yes

Rebate: 50 percent of the remaining claims funds

Choosing the right insurance plan for your employees is an important decision that can have a significant impact on your company's bottom line, as well as your employees' health and well-being. While both fully-funded and level-funded plans have their respective advantages and disadvantages, the decision ultimately rests with the employer. The best health insurance companies understand this and work closely with employers to help them navigate the decision-making process and choose the best plan for their business. At Curative, we recognize the importance of offering a range of health plan options to meet the unique needs of our clients. Whether you opt for our fully-funded plan or our level-funded plan, you can rest assured that your employees will receive high-quality care and enjoy access to our extensive PPO network of providers. Curative follows an innovative, collaborative approach to care, looking to provide employers with financially feasible, high-quality health insurance that fits their needs.

About Curative

Curative is a health plan that employees and employers will love. Our plan focuses on affordability, engagement, and simplicity, so people feel confident getting the care they need when they need it. Imagine—a health plan that actually delivers better health.

Affordability

People shouldn’t avoid doctor visits out of fear of surprise medical bills. After completing a Baseline Visit in the first 120 days of joining Curative, one monthly premium will enable:

$0 copays

$0 out-of-pocket fees

$0 preferred prescriptions

$0 deductibles for in-network care

Engagement

Curative builds engagement with members from day one by facilitating trusted relationships with a Baseline Visit and Care Navigator. Members will complete a Baseline Visit within 120 days of the plan’s effective date to create an individualized, preventive care plan with a Curative Care Navigator to reach their health and wellness goals. We also ensure members are connected to our large and inclusive provider network.

Simplicity

Curative makes care management virtually stress-free. The Curative Pharmacy has a partnership with a national network of pharmacies and even offers same-day delivery (for select cities). Members can access virtual urgent care in partnership with NormanMD in less than 10 minutes via messaging, audio, or video chat.

No copays. No deductibles. No...really. Curative is changing the way we view health insurance with a health plan that actually delivers health.

Patients experiencing a medical emergency should call 911 (or the local emergency number) immediately.

Eager to learn more about why Curative’s fully insured or level-funded plans are right for your workplace? Visit us at https://curative.com/.

To see all disclaimers, please view here.

References:

Annual family premiums for employer coverage average $22,463 this year, with workers contributing an average of $6,106, benchmark KFF employer health benefit survey finds. (27 Oct 2022). Kaiser Family Foundation. https://www.kff.org/private-insurance/press-release/annual-family-premiums-for-employer-coverage-average-22463-this-year/

Curative’s employer-based health benefits offering now available across the state of Texas. (22 Mar 2023). Business Wire. https://www.businesswire.com/news/home/20230322005343/en/Curative%E2%80%99s-Employer-Based-Health-Benefits-Offering-Now-Available-Across-The-State-of-Texas

Lenski, C. (11 Aug 2022). Health benefit cost growth will accelerate to 5.6% in 2023, Mercer survey finds. Mercer. https://www.mercer.us/newsroom/health-benefit-cost-growth-will-accelerate-in-2023.html

Norris, L. (19 Mar 2023). What is self-insured health insurance? Very Well Health. https://www.verywellhealth.com/what-is-self-insured-health-insurance-and-how-is-it-regulated-4688567

Pennachio, F. (24 Feb 2023). Self-funded plans: Examining the pros, cons, and misconceptions. Benefits Pro. https://www.benefitspro.com/2023/02/24/self-funded-plans-examining-the-pros-cons-and-misconceptions/

Sammer, J. (5 Apr 2021). Level-funded health plans: A steppingstone to self-funding. Society for Human Resource Management. https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/level-funded-health-plans-are-stepping-stone-to-self-funding.aspx

Stop-loss excess insurance. (n.d.) Self-insurance Institute of America. https://www.siia.org/i4a/pages/index.cfm?pageid=7535

2022 employer health benefits survey. (27 Oct 2022). Kaiser Family Foundation. https://www.kff.org/report-section/ehbs-2022-section-10-plan-funding/

Sign up for our Newsletter

Table of Contents

Fully insured plans

Level-funded plans

Curative’s fully-funded and level-funded plans